Sometimes you don’t want to be very active in trading your crypto, but you still want your portfolio to grow. At the time of first writing this in January of 2023, that is especially true given the current market conditions.

Here are my picks for the best passive income crypto strategies that I have come across in my experience.

Crypto4Winners

Overview

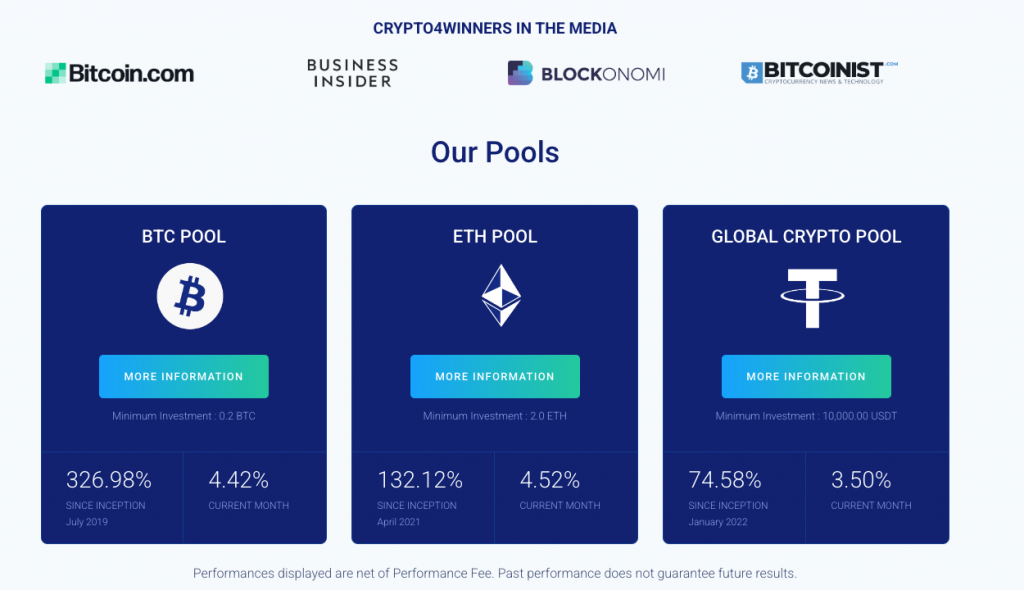

Crypto4Winners has been the one shining light in my portfolio during the beginning of this crypto winter. It has allowed me to compound my BTC and ETH by ~5% a month in passive income while waiting for the market to turn.

You simply have to hold your assets in their fund and you earn returns, compounded daily through their platform. They make low risk trades with large amounts to grow their investors funds regularly.

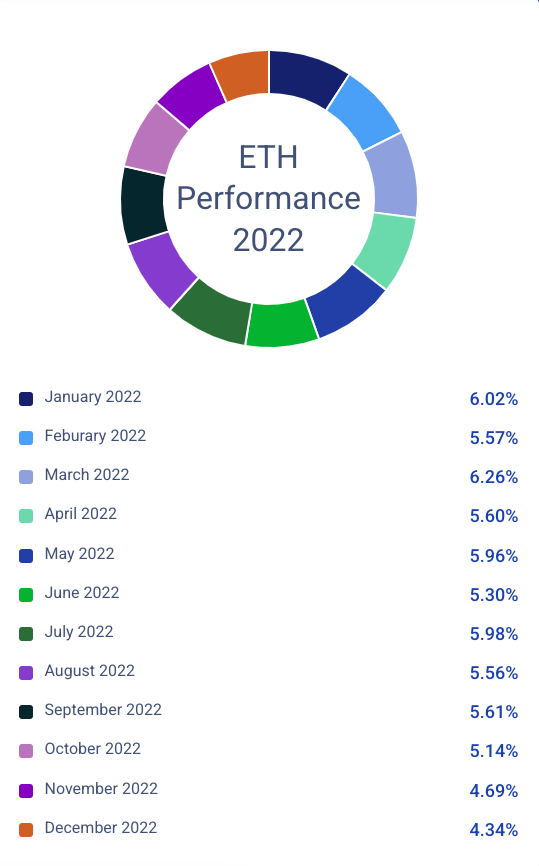

Here is their monthly performance in ETH over the past year:

As the price of ETH fluctuates, you continue to add on more ETH to your principle every day. I’ve grown my principle by 35% in the past 6 months without taking any action other than holding in this fund.

They also have a BTC and a USDT pool:

What I like/dislike about Crypto4Winners

Like

- Very easy to use, you simply deposit your funds into their website and you start earning in 24 hours.

- It is not cost prohibitive, as there are no upfront costs other than transaction fees.

- High security with Ledger Enteprise

Dislike

- The UI could be improved. They definitely have made many recent improvements but I still think the site could look a bit better.

- It would be nice if they had a mobile app to check your balances.

Conclusion

This is by far the best passive income crypto strategy that I have used, bar none. With trading and other methods, the risk is so much higher and you must invest a lot more time. I prefer more passive methods and Crypto4Winners really is a set and forget strategy. Your best bet is to get started as early as possible.

Trading Bots

Crypto trading can be a challenging and time-consuming process. But what if we told you that you could automate your trades and enjoy passive income while you sleep? Trading bots have become increasingly popular among crypto enthusiasts as they offer a convenient way to make trades without constant monitoring. In this post, we will introduce you to the top three crypto trading bots – Pionex, Haasbot, and Cryptohopper – and show you why they are the best in the game.

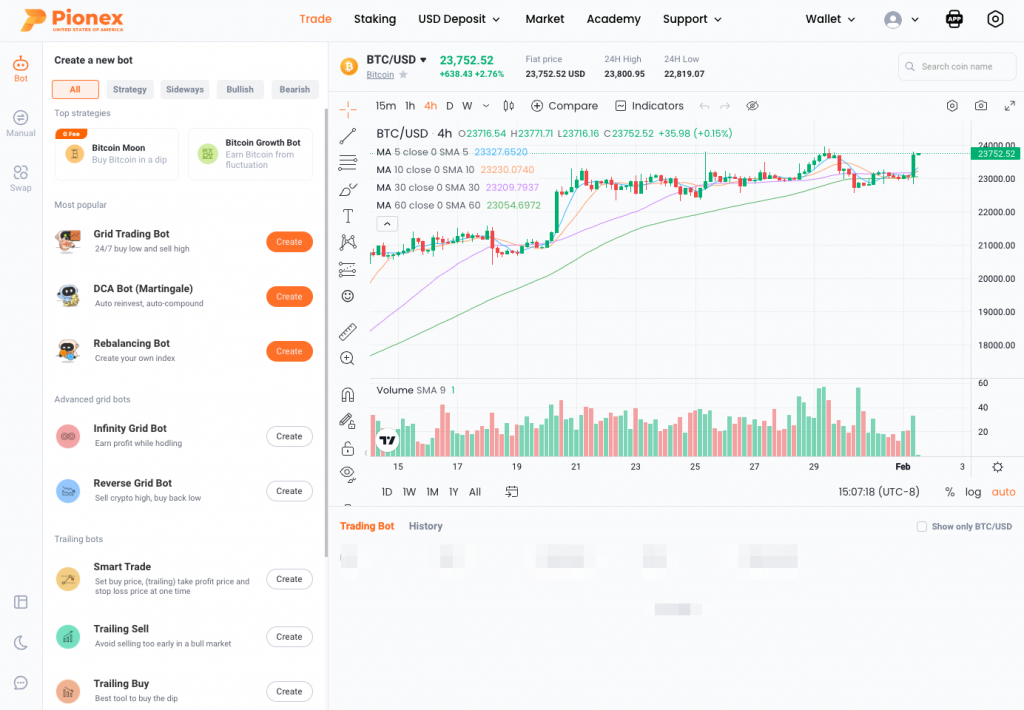

Pionex

- User-friendly interface: Pionex’s intuitive design makes it easy to use for both beginner and advanced traders.

- Built-in trading strategies: Pionex offers 12 built-in trading strategies, including grid trading and DCA, that traders can use to generate passive income.

- Multiple exchanges support: Pionex supports multiple exchanges, including Binance, Huobi, and KuCoin, allowing traders to manage their portfolio across different platforms.

- Grids trading bots: Pionex offers a unique grid trading bot, which automatically buys and sells cryptocurrencies at predetermined intervals.

HaasOnline

- Advanced trading strategies: HaasOnline offers advanced trading strategies, including inter-exchange arbitrage and automated safeties, for experienced traders.

- Customizable bots: HaasOnline allows traders to create and customize their own bots, giving them complete control over their trading strategies.

- Multiple exchanges support: HaasOnline supports multiple exchanges, including Binance, Bitfinex, and Kraken, making it easy for traders to manage their portfolios across different platforms.

- Technical analysis: HaasOnline advanced technical analysis tools, including candlestick patterns and Fibonacci retracements, help traders make informed trading decisions.

Cryptohopper

- User-friendly interface: Cryptohopper’s user-friendly interface makes it easy to use for both beginner and advanced traders.

- Automated trading: Cryptohopper allows traders to automate their trades, freeing up their time and reducing the risk of human error.

- Multiple exchanges support: Cryptohopper supports multiple exchanges, including Binance, Kraken, and Bitfinex, making it easy for traders to manage their portfolios across different platforms.

- Market indicators: Cryptohopper’s market indicators, including moving averages and Bollinger Bands, help traders make informed trading decisions.

Staking

Staking is a popular passive income strategy in the world of cryptocurrency, allowing users to earn rewards simply by holding onto their assets. In this post, we’ll explore the basics of staking, how it works, and why it’s becoming an increasingly popular way to generate passive income from crypto.

What is Staking?

- Staking is the process of holding onto a specific cryptocurrency for a set period of time in order to receive rewards in the form of new tokens.

- Unlike mining, which requires expensive hardware and significant technical know-how, staking is a simple and accessible way for individuals to participate in the validation and verification of transactions on a blockchain.

How Does Staking Work?

- In order to stake, users must first hold a certain amount of a specific cryptocurrency.

- Next, they must lock up their coins in a staking wallet, which is used to participate in the validation and verification of transactions on the blockchain.

- As a reward for their participation, users receive a portion of the new tokens generated by the network. The exact amount of rewards depends on a number of factors, including the amount of tokens held and the overall size of the network.

Why Staking is Becoming Popular

- Staking is a simple and accessible way for individuals to earn passive income from their crypto assets, without having to actively trade or sell their holdings.

- Unlike other passive income strategies, such as dividends, staking rewards are not subject to traditional financial market fluctuations, making it a relatively stable source of income.

- With more and more cryptocurrencies adopting staking as a way to secure their networks and incentivize participation, staking is becoming an increasingly popular way to generate passive income from crypto.

Examples of Popular Staking Cryptocurrencies

- Ethereum (ETH)

- Tezos (XTZ)

- Cosmos (ATOM)

- Algorand (ALGO)

- Cardano (ADA)

When it comes to staking, it’s important to carefully consider the specific cryptocurrency you choose to stake, as well as the wallet and exchange you use to manage your assets. Make sure to research the security, reliability, and reputation of any platform or exchange before making a decision.

Conclusion

Staking is a simple and accessible way for individuals to generate passive income from their crypto assets, with the potential for relatively stable and predictable rewards. With more and more cryptocurrencies adopting staking as a way to secure their networks and incentivize participation, it’s an opportunity worth considering for anyone looking to grow their passive income streams through cryptocurrency.

Yield Farming

One passive income crypto strategy that was popular in 2021-20222 is Yield farming. Yield farming is the process of lending or borrowing crypto assets to earn interest on them. This can be done through decentralized lending platforms such as Compound, Aave, or dYdX. This is a way to earn passive income on your crypto assets, but it also carries some risk, as it is a lending strategy.

Masternode

One passive income crypto strategy that I haven’t tried myself, but have heard a lot about is a masternode. A masternode is a full node that keeps a full copy of the blockchain and provides extra services to the network. Setting up a masternode requires a significant amount of a specific coin, but it can generate a steady stream of passive income for the operator.

Dividend-Paying Tokens

Another straightforward passive income crypto strategy is buying into tokens that pay dividends. Some tokens, such as NEXO, and BTT, pay dividends to their holders on a regular basis. Investing in these tokens can provide a steady stream of passive income.

Holding/HODLing

This passive income crypto strategy involves buying and holding a specific coin or token for a long period of time, with the expectation that the price will increase over time. While this strategy doesn’t provide a steady stream of passive income, it can potentially generate substantial returns over time.

This is the default strategy, but your asset base doesn’t grow like in all of the other strategies. When I’m looking for passive income crypto strategies, I want my principle to be growing over time.

Wrap-Up

What do you think about these passive income crypto strategies? Let me know your thoughts and if there are any other ways you’ve had success building passive income streams with Crypto.

Happy investing!